Can Early Alzheimer’s Detection Start at the Bank?

By: Vivian Vasallo and Arielle Burstein

When a Small Slip May Signal Something Bigger

We’ve all forgotten to pay a bill, lost track of a subscription or splurged on something we didn’t really need. But what happens when these mistakes become more frequent, more erratic, or go unnoticed entirely? And what if it’s not happening to us, but a parent or a loved one who’s reluctant to talk about their finances? These early signs can be easy to miss, or easy to dismiss, especially when money is a sensitive topic.

As scientists make major strides in the early detection of Alzheimer’s—including the recent approval of the first blood test to diagnose the disease1 — a new window of opportunity is opening: one where subtle, non-medical signs may help spot risk earlier. Among the most promising? A person’s financial habits.

Managing money taps into many of the brain’s most complex systems—planning, organization, memory, and self-control. Researchers are now uncovering how changes in financial decision-making may appear years before memory loss, even if everything still seems “normal", making them one of the first red flags of cognitive decline2.

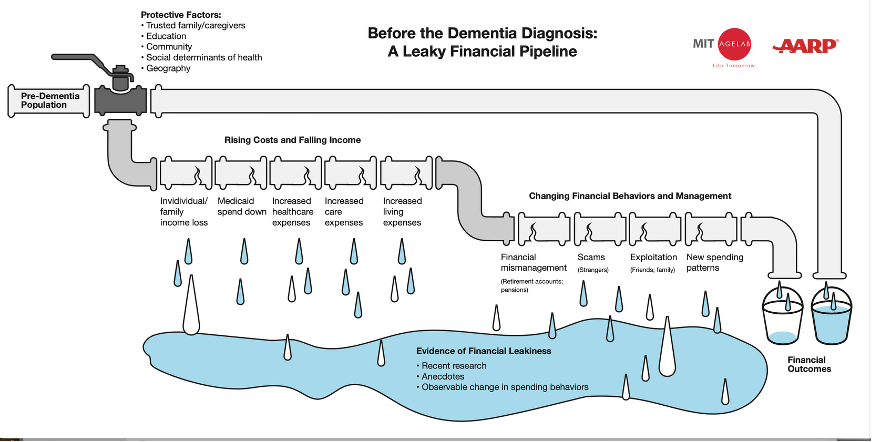

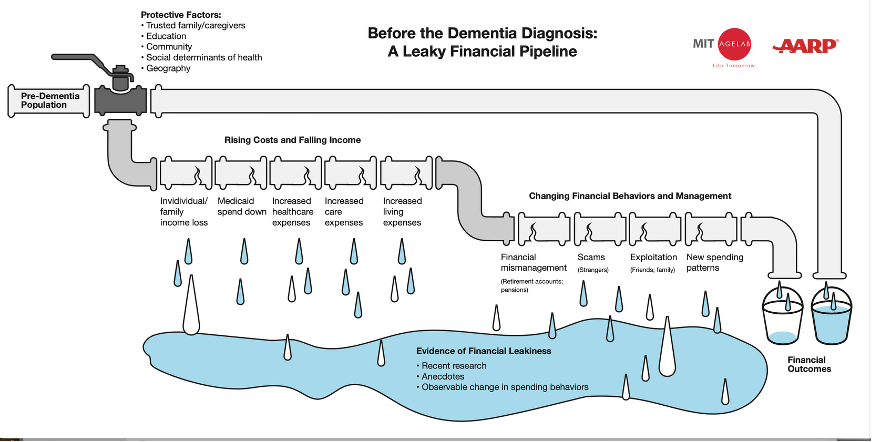

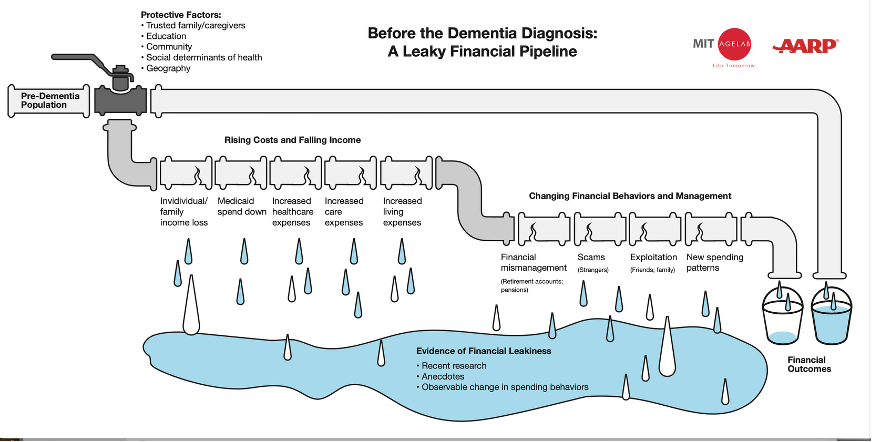

The period before an Alzheimer’s diagnosis can be hard to define, but we now know there can be signs, quietly and consistently building over time. The MIT AgeLab created a metaphor for this: they call it a “leaky financial pipe.” A few missed payments here, a strange charge there—slow, steady drips that seem minor until the damage is already done3.

Key Summary:

A pattern of financial mismanagement could be an early sign of Alzheimer's. Early warning signs may include:

- Missed or unpaid bills, especially for routine expenses (utilities, mortgage, insurance)

- Trouble managing a checkbook, budgeting, or calculating a tip

- Unusual purchases buying the same item multiple times, large donations, or impulsive spending

- Confusion about bank statements, credit card charges, or where money is going

- Lack of awareness that mistakes are happening

For many, repeated money mistakes may be one of the earliest visible signs that something isn’t right. Recognizing these shifts can help families step in sooner—protecting assets, independence, and quality of life—as well as allow for preventive steps for brain health that could potentially delay some symptoms. And because dementia often strikes earlier in communities of color—such as Hispanic and African-American families—these early financial warning signs may be especially critical4.

Red Flags – When It’s More Than Just A Financial Mistake

Missing a payment once may be common. But repeated mistakes—especially when someone doesn’t realize they’ve made them—could be an early sign of cognitive decline. Paying attention to financial behavior isn’t just about protecting money—it’s about protecting the people we care about.

A growing body of research suggests that changes in how someone manages money may be among the earliest outward signs of Alzheimer’s—often appearing years before a formal diagnosis. Several key studies help show how these early changes in financial behavior can show up—and just how big an impact they can have.

One study of Medicare recipients found that individuals ultimately diagnosed with Alzheimer’s began missing payments and experiencing declining credit scores up to six years before their diagnosis5. A 2023 analysis revealed just how significant the impact can be: U.S. household net worth dropped to less than half that of unaffected households—$104,000 compared to $217,000—over the eight years leading up to a diagnosis6

And in a study from USC Dornsife, researchers found that older adults who struggled to recognize risky financial decisions were more likely to show early brain changes associated with Alzheimer’s—suggesting that financial vulnerability could one day serve as an early screening tool7

Why do these shifts happen so early? Managing money draws on a set of complex cognitive skills known as executive function—things like planning ahead, staying organized, evaluating risk, and exercising self-control. These abilities are supported by regions of the brain such as the entorhinal cortex, which connects memory, decision-making, and emotional regulation. As this region deteriorates, subtle changes in financial behavior may be the first sign that something is off.

Early warning signs may include:

• Missed or unpaid bills, especially for routine expenses (utilities, mortgage, insurance)

• Trouble managing a checkbook, budgeting, or calculating a tip

• Unusual purchases—buying the same item multiple times, large donations, or impulsive spending

• Missed payments

• Confusion about bank statements, credit card charges, or where money is going

• Lack of awareness that mistakes are happening

Recognizing these changes early gives families a chance to step in with empathy—protecting financial well-being while also encouraging medical evaluation, future planning, and support8.

The Cost of Missed Signs – How Early Mistakes Can Add Up

Ignoring the early warning signs of Alzheimer’s doesn’t just delay a diagnosis—it can lead to serious financial consequences. A 2024 study estimates that over the next decade, 600,000 missed payments or financial issues will occur due to undiagnosed Alzheimer’s and related dementias. Losses can range from small, unnoticed amounts to catastrophic financial blows, such as the loss of a home or life savings.

The impact isn’t felt equally. Many Hispanic and Latino older adults live on low incomes, making them especially vulnerable to the financial toll of Alzheimer’s. For families managing tight budgets, even minor mistakes can have long-lasting effects9.

Financial abuse and fraud are a growing concern, particularly for older adults. AARP estimates that $28.3 billion is stolen from adults over 60 each year (10). Recognizing the early signs of financial mismanagement and putting safeguards in place can help reduce these risks and protect long-term financial security.

Alzheimer’s is a daunting diagnosis. It affects our families, our health, and our futures, but staying updated on the latest Alzheimer's resources and treatments helps you care for your loved one. This way, they get support that fits their needs.

What You Can Do – Steps to Protect Yourself and Your Finances

Protecting Assets

• Start financial planning early, before memory issues arise.

• Know the basics: where accounts are, how bills are paid, and sources of income.

• Have compassionate conversations—offer help without taking over.

• Simplify finances: consolidate accounts, use automatic bill pay, and minimize paperwork.

• Protect against fraud: enable alerts, join the Do Not Call list, and monitor for red flags.

• Put legal protections in place: consult an elder law or estate attorney and establish a durable financial power of attorney (11).

Taking BrainGuide

• Use BrainGuide™ to access brain health resources and a free memory questionnaire.

• Alzheimer’s often begins subtly—early signs may go unnoticed.

• Early detection is key: it leads to better care options and more effective planning.

• It empowers families to make decisions together while the person can still participate.

Talking to Your Healthcare Professional

• Prepare before the visit: know what questions to ask and what symptoms to mention.

• Clear communication makes it easier to get an accurate diagnosis and the right support

• Support your loved one by helping them navigate potentially overwhelming appointments (12).